29 Mar Certified invoice digitization auditor

As a certified invoice digitization auditor approved by the tax agency in this post I would like to collect some questions that all clients ask me as well as make a small inventory of documentation that is key when making the 4 documents that the tax agency asks to us.

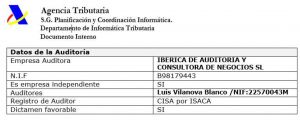

Certified auditor by the tax agency in certified digitization of invoices

What is certified digitization?

It is the technological process that allows, through the application of photoelectronic or scanner techniques, to convert the image contained in a paper document to a digital image encoded according to one of the standard formats in common use and with a level of resolution that are admitted by the State Tax Administration Agency. For this, it is necessary to use digitizing software approved by the Tax Agency. It is included in article 7 of Order EHA / 962/2007.

What steps must be followed to homologate certified digitizing software?

It is included in article 7 of Order EHA / 962/2007. Send the corresponding documentation, which proves that the requirements set forth in section 2 of article 7 of the aforementioned Order are met, to the Director of the IT Department of the State Agency for Tax Administration.

Where can I present the necessary documentation to approve certified digitizing software?

The documentation can be presented at any Registry Office in accordance with the provisions of article 38.4 of Law 30/92, of the Legal Regime of Public Administrations and the Common Administrative Procedure (LRJPAC).

What documentation must be presented in the application for approval of certified scanning software?

It is included in article 7 of Order EHA / 962/2007, section 3. The application for homologation of certified digitizing software must consist of:

Responsible declaration of compliance with the requirements of Order EHA / 962/2007.

Supporting documentation consisting of:

Description of the technical standards on which the certified digitization procedure is based, as well as the security, control and exploitation protocols or norms and procedures related to the creation and consultation of the documentary database.

The Quality Management Plan that is carried out throughout the digitization and signature process, and its influence on the image obtained and its metadata, as well as the description of device maintenance.

A report issued by an independent computer audit entity, with accredited technical solvency in the field of analysis and evaluation of the activity carried out, in which the opinion is expressed about compliance by the requesting entity with the conditions established in the Order cited above.

What documentation do I need to collect in order to qualify for certified scanning software?

Data structure or table with metadata fields, data types and meaning. Mapping with the required fields Accounting date, invoice number, capture date and time, buyer data, supplier data, Date and time of signature, signature, hash, total invoice, discounts, tax base and VAT (How many VAT does the invoice carry? ) and Invoice Date.

Data structure or table with support fields for closings. Data types and meaning

Period end algorithm.

Software update procedure.

Resolution, format and quality of the image in pre-processing.

Technical requirements of scanning devices.

Technical requirements of the devices to use the solution.

Permissions and security measures from capture to storage, metadata editing, query and close.

Minimum software requirements. Recommended operating systems and devices.

Security of hosting or on-premise installation.

Development and version control methodology.

Used technology. System architecture.

Among other documents …

If you need to apply for this key approval to be able to commercialize a software that scans invoices and simplified invoices allowing the client to eliminate paper, you can count on my experience and my success rate of 100% of solutions that I have presented to the AEAT.

Luis Vilanova Blanco. Certified digitalization of invoices auditor. CISA Auditor.

info@legalauditors.es

911277300